7 Envelopes Could Change Your Life!

I usually write on topics of church leadership, but this time I want to get very personal.

Like most couples, we struggled with our finances from early on. Even though we made a decent living, it seemed we were perpetually in the hole with almost no savings and no retirement. Every time Murphy showed up out popped the credit cards or line of credit. It felt so defeating.

So we did what many others have done. We got serious about getting on a budget and learning to control our spending.

As the quintessential nerd in our family, I spent hours pouring over our finances and entered everything into a software program. I analyzed every nickel and dime over the last seven years and was able to setup a comprehensive monthly budget. I felt confident that our newly crafted budget was going to finally put us on the right track and it worked! For about a week.

It wasn’t long until I saw the little budget-busters crawling in under the fence and chewing away at my master-crafted spending plan.

It seemed no matter how many times I tried to “adjust” the budget, moving items around, changing monthly estimates, etc., there were certain items in the budget that just didn’t seem to conform to a nice, neat, linear pattern. These items seemed as controllable as teenage girl’s mood swings. Enter grandma’s cure for expense gremlins: THE ENVELOPE SYSTEM

No, not some digital form of categorization or cutesy software solution. I’m talking old school, lick-the-glue, paper envelopes.

I’d heard about people (usually very old people) using an envelope system, but I always figured that’s what they had to use back in the great depression. 🙂

It wasn’t until I got sick and tired of the constant budget busters that I finally decided to try it. That was over 10 years ago and today I am an ENVELOPE EVANGELIST. I truly believe that using envelopes is the best way to tame the budget busters in your finances. Envelopes are not a replacement for a budget, they are a supplement to it. You still have to work out a budget and then renew it annually. Envelopes make the budget work!

“Money earned little by little will grow and grow.” (Proverbs 13:11b, CEV)

Over the years, as I’ve mentioned using envelopes in some of my sermons, people have asked me about my system. So I decided to write this blog.

My disclaimer is that this is what works for me. You have to make the adjustments in the amounts and categories to figure out what works for you. The goal is to isolate the items in your budget that are causing you the most grief and need to have money set aside. In essence these are basically sinking funds. WHAT’S A SINKING FUND?

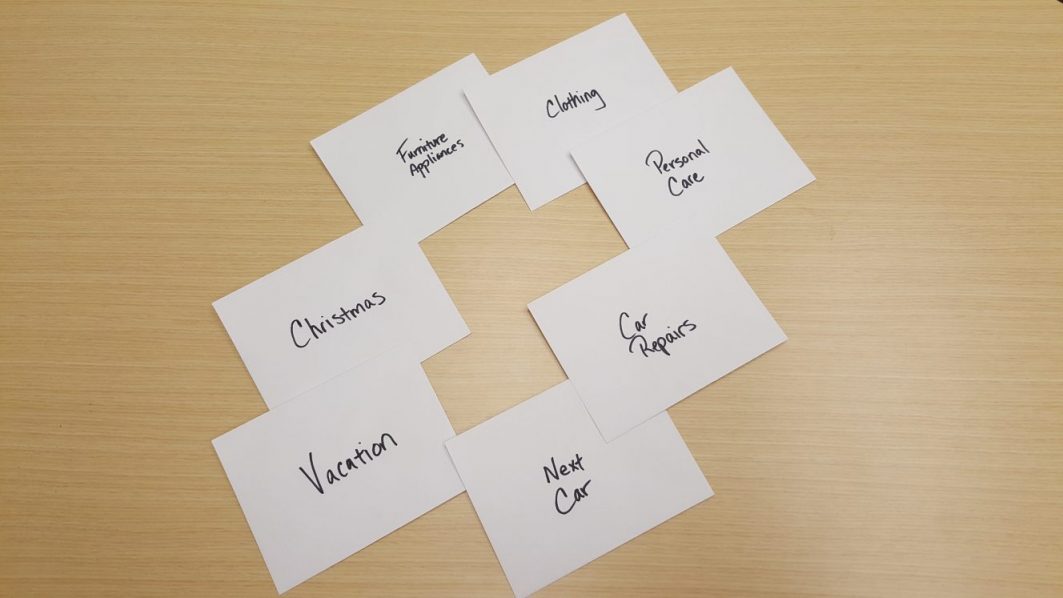

So, without further ado, what’s my system?

Because I get paid weekly via direct deposit, I make a weekly trip to the ATM. I take 25% of my weekly net pay out in cash and then I divide it up 8 ways. The rest of my paycheck is left in my checking account and is used to pay for all other budget items (tithe, savings, mortgage, groceries, utilities, gas, etc.).

To help you visualize this process, I’ll use made up amounts for purposes of illustration. Let’s pretend that my weekly deposit is $800. I would take $200 out of the ATM and then divide it up 8 ways:

1. Spending cash 50% = $100

Fact: you’re going to need some cash to help you avoid using plastic. Having a limited amount of cash in your wallet helps you to visually see what you’re spending and hopefully helps you to cut down on frivolous purchases.

For me, this amount then gets divided up between me and my spouse. 70% goes in my wallet so I can pay for our date day. 30% for her to have cash throughout the week.

2. Next Car 10% = $20

Notice I said NEXT not NEW. I’m assuming you already know why you probably should not buy new. If you’re curious, check out this article.

I design this percentage based on building up for the next car purchase in 6-7 years. The longer I wait, the better my next car is. In 7 years you’ll have over $7,000 which should be able to buy you something reliable. Remember, it’s transportation, not a fashion statement. 🙂

3. Christmas 10% = $20

Yes, this seems to keep happening year after year. We use to “try” not to go into debt each Christmas, but it never seemed to work until we designated an envelope. Now we are able to do all of our Christmas purchases without even using the full amount in the envelope! Trust me, that feels GOOD!

4. Vacation 10% = $20

If you take a vacation annually, then you’ll have about $1,000 to spend. Another idea is to build up this fund for a few years and do something bigger, say, Disney!

When we went on our 25th anniversary trip to Alaska, I had saved up for 5 years and we were able to enjoy a wonderful trip that made a lasting memory. Best of all, we came back home with NO DEBT!

5. Car Repairs 8% = $16

I used to only have the NEXT CAR envelope and then I found that I was “stealing” from it for car repairs. It finally dawned on me that I needed Murphy repellent for this category.

6. Furniture / Appliances 5% = $10

Whether it’s the dishwasher, hot water heater, television or just a new (to us) couch, this envelope builds over years.

7. Clothing 5% = $10

As anyone who has ever seen me can attest, this envelope doesn’t get used all the time. 😂 New clothes is just not a high value for me. When we do buy something, it’s usually from a thrift store. My wife is the queen of deals. I probably spend more on shoes than any other article of clothing.

8. Personal Care 2% = $4

Finally, personal care is basically for haircuts, etc. Fortunately, Lisa and I have been blessed with the perfect natural hair colors (cough, cough) so we don’t have to spend much in this category.

Again, the categories you use will probably be different and most certainly the amounts will be different, but the principles are transferable to anyone.

One thing to note: There are times when the cash flow is so tight that I am unable to pull money that week to put into the envelopes. This usually happens about 3-4 times a year. I use it as a wake-up call to see what’s happening to the budget that might need attention.

What categories would you add/subtract?

Scott Creager

Posted at 13:02h, 24 FebruaryI would add: mission fund. Step one is to get your passport and then start saving. For me, I have to double down since I don’t have paid vacation (self-employed). Time is one of my budget busters. I need to see that the wheels on my truck go round and round. Me and the wife do not use envelopes, we use bank accounts. We have multiple accounts with multiple banks. Tuck away into a bank away from your day to day life or budget. For one, it is more secure and, depending on the account, it can earn some interest. There are three groups who will literally steal from it, your family/kids, your spouse and lastly, YOU! If necessary, get a safe. I do have one envelope, it’s my pocket, labeled “No strings attached ” It’s for spontaneous purchases, like wow all three kids came from school with fundraiser packets at the same time, or they all have field trips, or crap the chicken isn’t defrosted better run and get a pizza, or there’s a homeless person who needs a meal, or a friend who needs help. I try to treat my pocket as a blessing envelope. Load it, let it go before you put money in (hint: It’s not yours, it’s His anyway ) and wait for divine appointments. Scott

Brian Moss

Posted at 00:10h, 25 FebruaryLove this addition!!!

Gary

Posted at 18:51h, 27 FebruaryLove it Scott!! good stuff bro!

Stacie Siers

Posted at 13:52h, 24 FebruaryI like the simplicity of your envelopes and the percentages. I use quite a few more envelopes than you, but I am still leaving out some important stuff. My envelopes consist of dog grooming, dog medicine, travel, out to eat, gifts, my hair up keep (I haven’t allowed my natural color to shine through just yet), co-pays/Rx, & college books (however I am officially finished with this one since my second child has finished her undergrad work this semester). We had the Christmas envelope in common. I am finally going to add clothes, furniture & cars & use your percentages. Thanks!

Brian Moss

Posted at 00:11h, 25 FebruaryGlad it was helpful!

Jacqueline Waters

Posted at 17:09h, 13 FebruaryThis is Fantastic. My niece has been doing this for years now; She’s been very successful using this method of budgeting. Thank you for the $ amounts I can do this! Thank You, Pastor Lloyd 🙏

Brian

Posted at 18:15h, 13 FebruaryYou’re very welcome! PS: This is Pastor Brian Moss, but I like Lloyd too. 😉

Krista Warfield

Posted at 11:33h, 14 FebruaryA few years ago we were doing just this (different categories) but the paycheck disbursement was the same. I am taking FPU again and now want to set up my envelopes again. Good topic to discuss with this next pay period.